Tripterium

Introducing Tripterium T50

Tripterium T50 is a tokenized, closed end index fund (CEF), which passively tracks the top fifty cryptocurrency assets by market capitalisation, in order to deliver healthy returns. The fund has a Venture Capital Feeder Fund, which will invest in expertly vetted early stage blockchain technology companies that are seeking to undertake an Initial Coin Offering (ICO), therefore benefitting from the ICO returns.

Exponential Growth

As blockchain technology matures, the Tripterium T50 index fund will simply harness the power of the markets to deliver healthy returns. At the time of writing, the total market cap of the crypto market has been fluctuating around $400 billion.

This might seem a lot, but when you take into consideration the size of other financial markets it really is not. Gold is a $7.7 trillion market, the global stock market is a $73 trillion market, the global real estate market is a $217 trillion market, and the derivatives market is a $544 trillion market. There is room for exponential growth in the crypto market.

Only 1% of the world’s population own cryptocurrency. Blockchain technology can solve dozens of previously intractable problems, like digital identities, supply chain integrity, data breaches and many, many more.

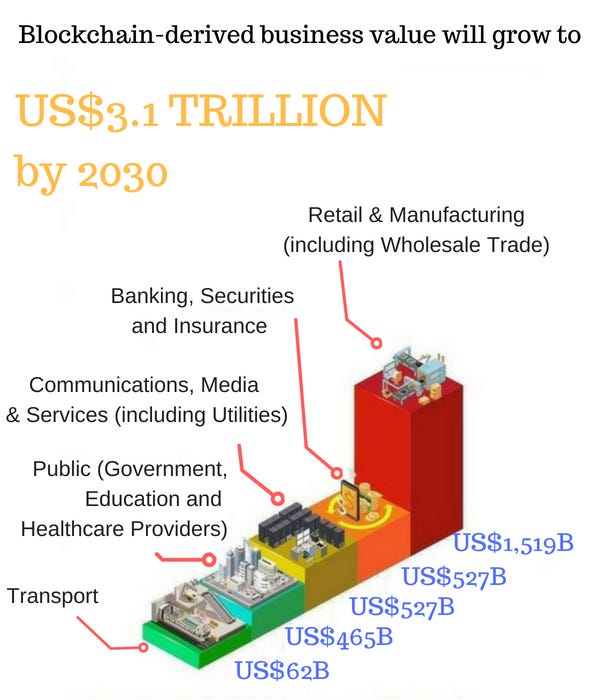

The use of blockchain technology within society has been exponentially increasing since it was introduced to the world in the whitepaper written by Satoshi Nakamoto.

According to Gartner Insights, blockchain, the driving force behind the crypto market is estimated to grow in business value to $3.1 trillion by 2030. The age of blockchain technology is just beginning.

The Efficient Market Hypothesis

The efficient market hypothesis (EMH) is a theory in financial economics stating that asset prices fully reflect all available information. Therefore, the stock market incorporates all available information about a stock causing the stock to be correctly priced. A direct implication is that it is impossible to consistently outperform the market on a risk adjusted basis since market prices should only react to new information.

The French mathematician Louis Bachelier was the first person to propose the efficient markets theory in his PhD thesis “The Theory of Speculation” in 1900.

Eugene Fama, further developed the efficient market hypothesis arguing that the only way for an investor to outperform the markets is either by chance or by investing in riskier investments.

Tripterium T50 has been structured to take advantage of the EMH theory. The T50 index fund will harness the power of the market to deliver healthy returns, while the Venture Capital Feeder Fund will invest in riskier ventures in order to gain from the higher returns associated with them. This allows for Tripterium T50 to consistently outperform the market and benefit from the fastest growing market in the world.

Anyone looking to get involved, please reach out.

· Join our Telegram community to be the first to be updated

· Follow us on Twitter

· Follow us on Facebook

· Follow us on Medium

· Follow us on Linkedin

· Follow us on YouTube

· Join the Newsletter

· Visit our Website

Komentar

Posting Komentar